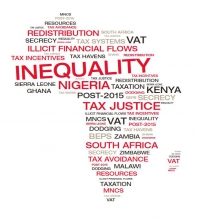

Africa rising?

Inequalities and the essential role of fair taxation

This new report investigates income inequality in eight sub-Saharan African countries (Ghana, Kenya, Malawi, Nigeria, Sierra Leone, South Africa, Zambia and Zimbabwe.)This study analyses tax systems in sub-Saharan Africa in the context of economic inequalities, given the primary importance of national tax systems in redistributing wealth.

The report looks at national taxation systems and international taxation issues – and, critically, the relationship between them. In this way it reveals how the enabling environment for tax dodging impacts on national tax systems in sub-Saharan Africa. It also dissects the trends in revenue generation, tax equity and tax reforms across the eight countries.

This report, published February 2014, has been produced by the Tax Justice Network Africa and Christian Aid in collaboration with members and partners, including Economic Justice Network (EJN), Studies in Poverty and Inequality Institute (SPII), Alternative Information and Development Centre (AIDC), African Forum and Network on Debt and Development (AFRODAD), Centre for Trade Policy and Development (CTPD), Centre for Social Concern (CfSC), Budget Advocacy Network (BAN), National Advocacy Coalition on Extractives (NACE), Ghana Integrity Initiative (GII), and the Tax Justice and Governance Platform Nigeria.

Click here for the PDF of the report Africa rising? Inequalities and the essential role of fair taxation